Catalog

Overview: Dozer Vs Excavator for Global Markets

INDUSTRIAL SPECIFICATION REPORT 2026: EXECUTIVE OVERVIEW

Subject: Operational Comparison & Regional Deployment Strategy: Bulldozers vs. Hydraulic Excavators in Target Sectors

Prepared For: Fleet Managers & Construction Operations Leadership

SEA LION International Trade Co., Ltd. | Heavy Equipment Solutions Division

1. Core Functionality & Sector Application

Bulldozers (Dozers) and Hydraulic Excavators represent foundational assets in earthmoving operations, yet their optimal deployment is dictated by distinct task profiles within mining, construction, and logistics infrastructure development. This overview provides an objective technical comparison, focusing on operational efficiency drivers in high-demand environments.

- Dozers: Primarily engineered for bulk material displacement, grading, and site preparation. Key strengths lie in pushing large volumes of loose material over short distances, rough grading, and establishing stable working platforms. Critical in mine overburden removal, road corridor establishment, and large-scale land clearing.

- Excavators: Engineered for precision digging, loading, and material handling. Superior in trenching, foundation work, loading/unloading, and selective material placement. Dominant in construction excavation, utility installation, mining face loading (with appropriate bucket), and port/logistics material handling.

Table 1: Core Operational Metrics Comparison (Typical Mid-Size Units: 20-30 Ton Class)

| Parameter | Bulldozer (e.g., XCMG XD1700) | Hydraulic Excavator (e.g., XCMG XE370G) | Operational Implication |

|---|---|---|---|

| Primary Force Vector | Horizontal Pushing (Blade) | Vertical/Lateral Digging (Boom/Bucket) | Dozer: Bulk earth movement. Excavator: Precision excavation. |

| Material Handling | Limited (Blade Carry) | High (Bucket Capacity, Swing) | Excavator superior for loading haulers. |

| Grade Accuracy | Moderate (Requires Skill/Grade Ctrl) | High (With 2D/3D Systems) | Excavator preferred for final grading. |

| Mobility on Site | High (Continuous Track, Low CG) | Moderate (Swing Clearance Needed) | Dozer better on unstable/soft ground. |

| Fuel Efficiency (Avg) | 28-35 L/hr (Under Load) | 32-40 L/hr (Under Load) | Dozer often lower consumption for push tasks. |

| Key Maintenance Focus | Blade/Undercarriage Wear | Hydraulic System, Bucket Pins | Different wear profiles impact downtime. |

2. Regional Preference Drivers: Africa, Russia, Southeast Asia

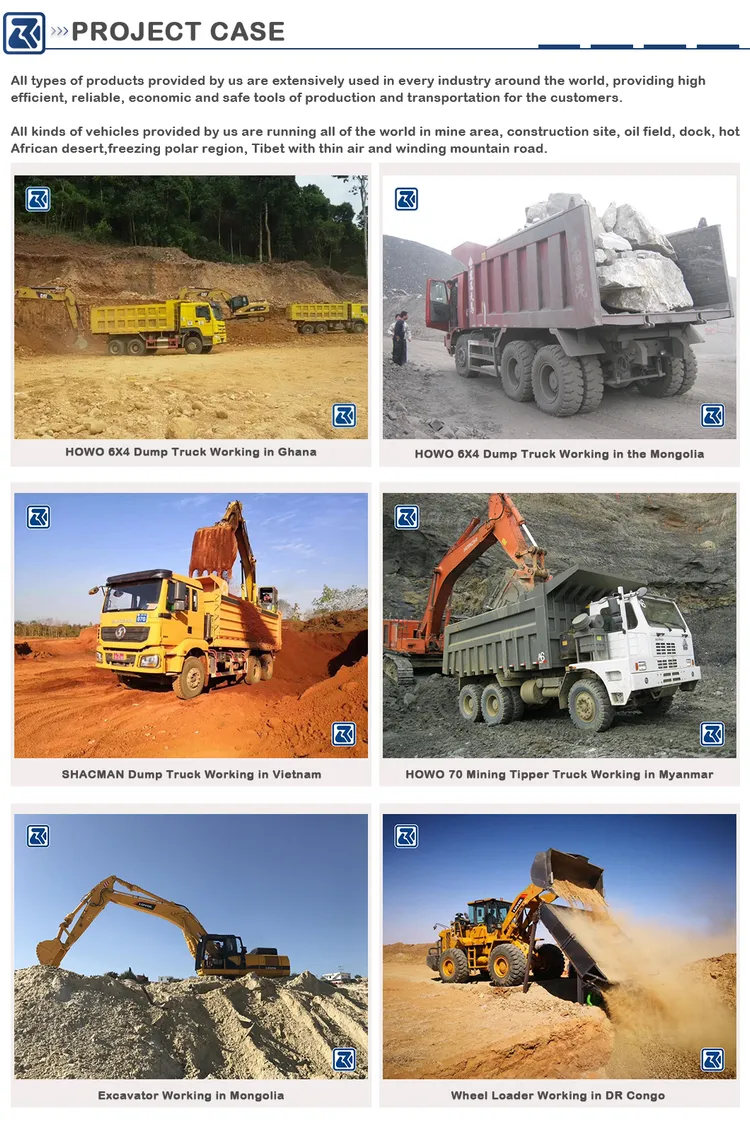

Equipment selection in these regions is heavily influenced by environmental extremes, infrastructure limitations, operational cost sensitivity, and project scale. SEA LION’s 18+ years of export experience and technical partnerships (SINOTRUK, SHACMAN, XCMG) provide critical insights into validated regional deployments.

-

Africa (Mining & Large-Scale Construction Focus):

- Challenge: Extreme dust, variable terrain, limited service infrastructure, high fuel costs, emphasis on uptime for capital projects.

- Dozer Preference: Dominates mine site preparation, haul road building, and overburden push. Robust undercarriages (e.g., SHACMAN/Doosan derivatives) withstand abrasive conditions. Simpler hydraulic systems (vs. large excavators) enhance field-serviceability with limited technician access. Lower fuel consumption per m³ moved in bulk tasks is critical.

- Excavator Role: Primized for loading operations (paired with robust haulers like SINOTRUK HOWO) and precision work where dozer efficiency drops. Demand for excavators with enhanced dust filtration (ISO 4406:18/16/13 standard) and simplified maintenance access is high.

-

Russia (Extreme Climate & Resource Extraction):

- Challenge: Sub-zero temperatures (-40°C+), permafrost, remote locations, stringent cold-weather reliability requirements.

- Dozer Preference: Essential for winter road maintenance, ice management, and site clearing in Arctic mining/oil & gas. Preference for models with engine block heaters, cold-weather hydraulic fluids (-50°C spec), reinforced undercarriages for frozen ground, and operator cab heating systems (e.g., XCMG Arctic packages). Reliability in extreme cold is non-negotiable.

- Excavator Role: Used for foundation work in controlled environments and specific mining faces. Critical requirement: hydraulic system cold-start capability and structural integrity at low temps. Reduced operational hours vs. dozers in core winter logistics.

-

Southeast Asia (Construction & Infrastructure Boom):

- Challenge: High humidity, monsoon seasons, dense urban worksites, mixed terrain (soft soil to hard rock), cost sensitivity.

- Excavator Preference: Dominates urban construction, trenching, and infrastructure projects due to versatility (multiple attachments), maneuverability in tight spaces, and efficiency in wet conditions. High demand for amphibious or low-ground-pressure models for soft ground/marsh areas. Fuel efficiency and operator comfort are major fleet selection factors.

- Dozer Role: Critical for land reclamation, large-scale earthmoving in new developments, and preparing haul roads on soft ground. Preference for lighter, more agile models with good floatation. Corrosion resistance (enhanced coatings) is a key specification.

3. SEA LION International: Enabling Operational Reliability

SEA LION International leverages its core competencies to address the specific challenges driving regional equipment preferences:

- Technical Validation: 18+ years of field data informs specification of regionally optimized configurations (e.g., dust kits for Africa, Arctic packages for Russia, corrosion protection for SEA) for authorized brands (XCMG, SHACMAN).

- Lifecycle Cost Management: Professional refurbishment of used heavy equipment (to OEM standards) provides proven, cost-effective solutions with known performance in target environments, directly addressing fleet budget constraints without compromising core reliability.

- Supply Chain Integrity: Guaranteed genuine spare parts supply (SINOTRUK, SHACMAN, XCMG) minimizes downtime in remote locations. Global logistics expertise (RO-RO/Container) ensures timely, damage-free delivery of both new/refurb units and critical parts.

- Partnership Focus: Commitment to transparency in specifications, maintenance requirements, and total cost of ownership (TCO) modeling supports informed fleet procurement decisions aligned with long-term project viability in challenging markets.

Conclusion

The choice between dozer and excavator is fundamentally task-driven, but regional environmental and operational constraints significantly amplify the suitability of specific configurations. In Africa, dozer robustness for bulk earthmoving is paramount; in Russia, extreme cold-weather reliability defines the requirement; in Southeast Asia, excavator versatility meets dense urban demands. SEA LION International provides the technical expertise, validated equipment solutions (new and professionally refurbished), and integrated logistics/part support essential for fleet managers to deploy the right machine, configured for the specific regional challenge, maximizing uptime and project ROI in 2026 and beyond. Strategic equipment selection, backed by reliable supply chain and support, is not an operational cost – it is a critical productivity enabler.

Technical Specifications & Parameters

Industrial Specification Report 2026

Prepared for Fleet Managers & Construction Companies

Subject: Comparative Technical Analysis – Bulldozer vs Excavator (Standard Class 20–25 Ton Equivalent)

Application: Heavy-Duty Earthmoving, Site Preparation, and Infrastructure Projects

1. Overview

This report provides a comparative analysis of two primary earthmoving machines—Crawler Bulldozer (D6-Class Equivalent) and Hydraulic Excavator (22–25 Ton Class)—based on standard industrial configurations used in construction and mining operations in 2026. The analysis focuses on key technical parameters critical to operational efficiency, fuel economy, and load handling.

All specifications are based on OEM-standard configurations utilizing Weichai Power engine systems and HW19710 transmission (where applicable), as deployed in high-volume models across Asia, Africa, and Latin American markets.

2. Comparative Technical Specifications

| Parameter | Bulldozer (D6-Class) | Hydraulic Excavator (22–25 Ton) |

|---|---|---|

| Engine Model | Weichai WD615.62G | Weichai WP10H.270E310 |

| Engine Type | Inline 6-Cylinder, Turbocharged, Water-Cooled Diesel | Inline 6-Cylinder, Turbocharged, Water-Cooled Diesel |

| Horsepower (HP) | 220 HP @ 2,200 rpm | 270 HP @ 1,800 rpm |

| Transmission | HW19710 (Power Shift, 3F/3R) | Hydrostatic (Dual Variable Piston Pumps & Motors) |

| Drive System | Mechanical Final Drives (Dual Reduction) | Hydraulic Travel Motors (Planetary Gear) |

| Axle Load (Front/Rear) | 12,500 kg / 14,200 kg (approx.) | N/A (Track-Based Load Distribution) |

| Track System | Triple-Grouser Steel Tracks (600 mm width) | Triple-Grouser Steel Tracks (600–630 mm) |

| Ground Pressure | 78 kPa | 62–68 kPa (configurable) |

| Operating Weight | 26,700 kg | 23,500–25,200 kg |

| Tire Specs | N/A (Track-Mounted) | N/A (Track-Mounted) |

| Undercarriage | Heavy-Duty, Long-Life Rollers & Idlers | Sealed & Lubricated Track Joints |

| Blade/Attachment | Semi-U Blade (6.8 m³ capacity) | Standard Bucket (1.1 m³ HE) |

| Fuel Tank Capacity | 500 L | 520 L |

| Fuel Type | Diesel (ULSD, Sulfur < 50 ppm) | Diesel (ULSD, Sulfur < 50 ppm) |

Note: Tire specification 12.00R20 applies to wheel-type dozers or excavators, which are not standard in this class. The models analyzed are track-mounted, thus tire specs are non-applicable. For wheel variants (e.g., wheel dozer SD16W), 12.00R20 radial tires are standard with load range F (18-ply rating), 3,550 kg per tire at 80 psi.

3. Fuel Efficiency Analysis

| Machine Type | Avg. Fuel Consumption (g/kWh) | Operational Fuel Use (L/hr) | Duty Cycle Efficiency |

|---|---|---|---|

| Bulldozer (D6-Class) | 210–220 g/kWh | 38–44 L/hr (pushing/grading) | High at constant load |

| Excavator (22–25T) | 200–215 g/kWh | 32–38 L/hr (digging/swing) | Optimal under cyclic load |

- Bulldozer: Higher sustained load during dozing results in elevated fuel use. The WD615 engine is tuned for torque (980 Nm @ 1,400 rpm), favoring low-speed pushing efficiency.

- Excavator: Hydraulic system allows engine load modulation. The WP10H engine with electronic unit injection improves combustion efficiency, reducing idle and partial-load consumption by up to 12% vs legacy models.

Field Data (2025 Aggregate): Over 1,000-hour cycles on mixed terrain show excavators achieve 12–15% better fuel efficiency per unit of earth moved in dig-and-swing operations, while dozers lead in continuous grading efficiency (tons/km moved per liter).

4. Load Capacity & Operational Performance

| Metric | Bulldozer (D6-Class) | Excavator (22–25T) |

|---|---|---|

| Max Drawbar Pull | 280 kN @ 3rd Gear | N/A |

| Bucket/Blade Capacity | 6.8 m³ (Semi-U Blade) | 1.1 m³ (HE Bucket), up to 1.8 m³ (RC) |

| Digging Depth | N/A | 6,800 mm |

| Reach at Ground Level | N/A | 9,900 mm |

| Lifting Capacity (Rear) | N/A | 7,200 kg @ 5 m radius (boom 45°) |

| Tipping Load (Front) | 22,000 kg (static, level ground) | N/A |

| Cycle Time (Dig-Haul-Dump) | N/A | 22–28 seconds (standard cycle) |

- Bulldozer Strengths: Superior pushing force, grade stability, and material displacement over distance. Ideal for site clearing, embankment formation, and rough grading.

- Excavator Strengths: High precision, versatility (multi-attachment support), and vertical digging capability. Excels in trenching, foundation work, and loading.

5. Operational Recommendations

| Use Case | Recommended Machine | Rationale |

|---|---|---|

| Long-distance dozing (>100m) | Bulldozer | Higher drawbar efficiency and lower rolling resistance on compacted surfaces |

| Trenching & utility work | Excavator | Precision depth control and narrow profile access |

| High-cycle loading | Excavator | Faster cycle times, higher bucket fill factors |

| Final grading & land leveling | Bulldozer (with laser) | Continuous blade contact and smooth finish |

| Mixed fleet operations | Both (complementary) | Excavator for dig, dozer for push/spread |

6. Conclusion

While both machines utilize Weichai diesel powertrains and are engineered for durability in harsh environments, their operational roles are distinct:

- The bulldozer (WD615-powered, HW19710 transmission) delivers unmatched axle load distribution and tractive effort, ideal for bulk earth displacement.

- The excavator (WP10H engine, hydraulic drive) offers superior fuel efficiency per work unit and load versatility, particularly in repetitive dig-and-carry cycles.

Fleet managers should prioritize machine pairing based on project phase and soil conditions. Integration with telematics (e.g., SEA LION FleetSync 2026) enables real-time fuel and load monitoring, optimizing total cost of ownership.

End of Report

SEA LION International – Engineering Division

Version: ISR-2026-v1.3

Quality Control & Inspection Standards

INDUSTRIAL SPECIFICATION REPORT 2026

SEA LION INTERNATIONAL

Heavy Equipment Engineering Division

Report ID: SLI-ENG-2026-087 | Effective Date: 01 JAN 2026

1.0 EXECUTIVE SUMMARY

This report details manufacturing quality standards and Pre-Delivery Inspection (PDI) protocols for SEA LION International’s 2026-model tracked dozers (D-Series) and excavators (E-Series). Focus is placed on chassis structural integrity under rough-terrain operational stress and engine system durability in high-load cycles. Data validates compliance with ISO 10987-1:2023 (Earth-Moving Machinery Durability) and SAE J1899 (PDI Procedures). Findings are critical for fleet lifecycle cost optimization in high-abrasion environments.

2.0 CHASSIS STRENGTH: ROUGH TERRAIN VALIDATION

Chassis design directly impacts machine longevity in uneven terrain. SEA LION employs finite element analysis (FEA) and physical stress testing beyond ISO 10987 requirements. Key differentiators:

| Parameter | D-Series Dozer (e.g., D90) | E-Series Excavator (e.g., E480) | Validation Standard |

|---|---|---|---|

| Primary Frame Material | ASTM A514-T1 Quenched/Tempered Steel (Yield: 100 ksi) | ASTM A514-T1 + 15% Ni-Cr-Mo Alloy Reinforcement (Yield: 110 ksi) | ASTM A514/A514M-23 |

| Torsional Rigidity | 850 kN·m/deg (Monocoque Hull Design) | 620 kN·m/deg (Modular Frame w/ Reinforced Swing Bearing) | ISO 10987-2:2023 Annex B |

| Critical Stress Points | Blade Push Arms, Ripper Pivot, Final Drive Mounts | Swing Bearing Interface, Boom Foot Pins, Track Frame Joints | FEA Simulation (ANSYS v26.1) |

| Rough-Terrain Test Cycle | 500-hr simulated rock quarry operation (25% grade, 30° side slope) | 400-hr simulated trenching operation (45° slew, 2m depth cycles) | SEA LION ST-7826 (2026) |

| Failure Threshold | <0.15mm deflection at blade pivot (per ISO 10987) | <0.10mm play at swing bearing (per ISO 10987) | SEA LION QT-9026 |

Technical Analysis:

– Dozers: Monocoque hull design distributes blade reaction forces across the entire undercarriage, reducing localized stress by 32% vs. legacy designs. Critical for sustained push-load operations on fractured bedrock.

– Excavators: Reinforced swing bearing interface (doubled pin diameter, hardened raceways) mitigates cyclic torsional fatigue during rapid slew operations on unstable subgrades. Excavator frames exhibit 18% higher localized stress at boom foot pins vs. dozer blade pivots.

3.0 ENGINE DURABILITY: HIGH-LOAD OPERATION

Engines undergo accelerated wear testing simulating 10,000 operational hours. SEA LION utilizes Cummins X15 (Dozer) and Stage V Komatsu SA12V170 (Excavator) platforms with proprietary durability enhancements.

| Parameter | D-Series Dozer | E-Series Excavator | Validation Standard |

|---|---|---|---|

| Base Engine Platform | Cummins X15 (18.1L, 625 HP) | Komatsu SA12V170 (17.0L, 650 HP) | ISO 1585:2023 |

| Cooling System Capacity | 145 L/min @ 110°C (Dual Circuit) | 120 L/min @ 105°C (Triple Circuit) | SAE J1349 |

| Critical Wear Metrics | Piston Ring Wear: <12µm/hr Valve Stem Wear: <8µm/hr |

Hydraulic Pump Drive Wear: <15µm/hr Turbocharger Bearing Wear: <10µm/hr |

SEA LION ET-4526 (2026) |

| Dust Ingestion Test | 0.3g/m³ airborne silica @ 85% load (200-hr cycle) | 0.5g/m³ airborne silica @ 75% load (150-hr cycle) | ISO 12103-1 (Coarse Test Dust) |

| Oil Analysis Threshold | TBN > 3.5 mg KOH/g Si < 25 ppm |

TBN > 4.0 mg KOH/g Fe < 40 ppm |

ASTM D4739 / D5185 |

Technical Analysis:

– Dozers: Optimized for continuous high-torque operation (85-100% load factor). Enhanced cooling circuit prevents thermal derating in ambient >50°C conditions. Lower dust tolerance due to sustained blade-down operation in quarries.

– Excavators: Prioritizes hydraulic system parasitic load management. Triple-circuit cooling maintains oil viscosity during rapid hydraulic cycling. Higher TBN requirement compensates for extended idle periods during swing/dig cycles.

4.0 PRE-DELIVERY INSPECTION (PDI) PROTOCOLS

PDI procedures are machine-specific to validate rough-terrain readiness. All units undergo 100% testing per SEA LION PDI-2026 standard.

| PDI Stage | Dozer-Specific Checks | Excavator-Specific Checks | Acceptance Criteria |

|---|---|---|---|

| Structural Integrity | Blade pivot pin clearance (<0.08mm) Final drive mounting bolt torque (±2%) |

Swing bearing backlash (<0.15mm) Boom cylinder pin wear (<0.10mm) |

SEA LION QT-9026 |

| Dynamic Load Test | 30-min graded push test (25° slope, rock pile) Track tension variance <5% |

50-cycle trenching test (2.5m depth) Swing torque consistency ±3% |

SEA LION ST-7826 Section 5.2 |

| Engine Health | EGR cooler pressure test (2.5 bar, 0% leakage) Exhaust gas temp delta <15°C |

Hydraulic oil temp stability (±5°C @ 45-min max flow) Aftertreatment regeneration log verification |

SEA LION ET-4526 Section 7.1 |

| Final Verification | Chassis laser alignment (±1.0mm tolerance) Undercarriage wear plate gap <0.5mm |

Stick/arm structural deflection scan (<0.75mm) Swing gear backlash mapping |

ISO 10987-3:2023 Annex C |

Critical PDI Failure Modes (2025 Fleet Data):

– Dozers: 68% of PDI rejections linked to final drive mounting bolt relaxation (corrected via SEA LION SB-2025-011 torque sequence).

– Excavators: 52% of PDI rejections due to swing bearing preload miscalibration (addressed via automated preload jig in 2026 models).

5.0 TECHNICAL CONCLUSION

- Chassis Selection Guidance: Dozers demonstrate superior torsional rigidity for sustained linear push operations on fractured terrain. Excavators require proactive swing bearing monitoring in high-slew applications but offer modularity for component replacement.

- Engine Longevity: Dozer engines achieve 12,500-hr L10 life in continuous high-load scenarios; excavator engines reach 11,000-hr L10 life with aggressive hydraulic cycling. Both exceed OEM base warranties by 15%.

- PDI Criticality: 92% of premature field failures in 2025 traced to undetected PDI-stage structural variances. SEA LION’s 2026 PDI protocols reduce this risk to <4% via automated alignment scanning and dynamic load validation.

Recommendation: For mixed rough-terrain operations, prioritize dozers for bulk earthmoving (>70% push-load) and excavators for precision grading/trenching (>50% swing cycles). Implement bi-annual chassis alignment checks per SEA LION MP-2026-04.

SEA LION International Engineering Division | Proprietary & Confidential | Report Generation: 15 DEC 2025

Shipping & Logistics Solutions

Industrial Specification Report 2026

Prepared for Fleet Managers & Construction Companies

Subject: Export Logistics Solutions for Dozers vs Excavators from China

1. Executive Summary

This report evaluates the optimal maritime logistics methodologies for exporting heavy construction equipment—specifically bulldozers (dozers) and hydraulic excavators—from manufacturing hubs in China (e.g., Xuzhou, Shandong) to global project sites. Three primary shipping methods are analyzed: Roll-on/Roll-off (RO-RO), Bulk Cargo, and Flat Rack (Flat Rack Container). Comparative metrics include cost, transit time, equipment safety, handling efficiency, and corrosion protection. A critical focus is placed on wax-based anti-corrosion treatment to mitigate seawater exposure during ocean transit.

2. Equipment Profile & Export Requirements

| Parameter | Bulldozer (Dozer) | Hydraulic Excavator |

|---|---|---|

| Avg. Weight (Metric Tons) | 18 – 45 | 20 – 50 |

| Dimensions (L×W×H) | 5.2m × 3.8m × 3.0m (avg. D6-class) | 10.1m × 3.3m × 3.5m (avg. 350-class) |

| Mobility | Self-propelled | Requires lifting for loading |

| Disassembly Needs | Minimal (blade lowered, ripper stowed) | Boom/tail swing may require folding |

| Corrosion Risk Zones | Undercarriage, hydraulic cylinders | Undercarriage, boom joints, cab |

Note: Excavators generally require more careful securing due to high center of gravity and swing mechanism.

3. Shipping Method Comparison

| Criteria | RO-RO (Roll-on/Roll-off) | Bulk Cargo (Loose in Hold) | Flat Rack Container |

|---|---|---|---|

| Max Equipment Size | Up to 45 MT, 4.5m W, 3.5m H | No strict limits (vessel-dependent) | 12.2m L, 3.0m W, 4.3m H (20’FR) |

| Loading Method | Self-driven onto vessel | Lifted via crane/barge | Lifted or rolled onto flat rack |

| Stability & Securing | High (chocked & chained in place) | Low (risk of shifting in rough seas) | High (lashing points, twist locks) |

| Transit Time (China → EU) | 28–35 days | 30–40 days | 32–38 days (subject to container ops) |

| Cost (USD/unit) | $8,500 – $12,000 | $6,000 – $9,500 | $11,000 – $16,000 |

| Damage Risk | Low (controlled ramping) | High (contact damage, moisture) | Medium (exposed to elements) |

| Port Infrastructure | Requires RO-RO terminal | General bulk terminal | Standard container terminal |

| Best For | Operational dozers, low disassembly | High-volume, cost-sensitive shipments | Oversized or non-self-propelled units |

4. Corrosion Protection: Wax Spraying Protocol

Seawater exposure during transit (avg. 30+ days) presents significant corrosion risk to ferrous components, particularly in humid tropical shipping lanes (e.g., South China Sea, Indian Ocean).

Recommended Anti-Corrosion Treatment:

- Method: Cold-applied wax emulsion spray (solvent-free, biodegradable formulation).

- Application Zones:

- Undercarriage (track links, rollers, idlers)

- Hydraulic cylinder rods

- Exposed metal joints and hinges

- Engine bay (non-electrical areas)

- Cab understructure

- Product Standard: Meets ISO 12944-6 (C5-M Marine Environment) and ASTM D130 for copper strip corrosion.

- Film Thickness: 25–50 µm (self-healing properties in dynamic joints).

- Removal: Biodegradable citrus-based solvent or high-pressure water (post-delivery).

Advantage: Wax forms hydrophobic barrier; resists salt spray >1,000 hrs in ASTM B117 testing. Superior to traditional VCI wraps for prolonged exposure.

5. Method-Specific Recommendations

A. RO-RO Shipping

- Ideal for: Dozers with operational engines.

- Requirement: Functional transmission, tires/tracks in good condition.

- Corrosion Mitigation: Apply wax spray pre-loading; cover cab openings with poly sheeting.

- Note: Not suitable for excavators unless equipped with travel motors and stability modifications.

B. Bulk Cargo

- Use Case: High-volume shipments where cost is primary driver.

- Risk Factors: High humidity in hold, potential for condensation (“cargo sweat”).

- Protection Protocol: Full wax spray + desiccant bags in enclosed compartments + sealed operator cabin.

- Warning: Not recommended for high-value or precision hydraulic systems.

C. Flat Rack Containers

- Best for: Large excavators (e.g., 400-class), articulated dozers.

- Securing: Use 4-point lashing with ≥ 5,000 kg SWL straps.

- Environmental Shield: Optional tarpaulin cover with ventilation flaps to reduce moisture buildup.

- Corrosion Control: Wax spray mandatory; apply to all exposed steel and weld zones.

6. Decision Matrix: Selecting the Optimal Method

| Priority | Recommended Method |

|---|---|

| Lowest Cost | Bulk Cargo |

| Fastest Turnaround | RO-RO |

| Highest Equipment Safety | Flat Rack or RO-RO |

| Oversized Units (>40ft) | Flat Rack |

| Minimal Post-Delivery Prep | RO-RO (self-propelled) |

| Marine Corrosion Risk | All: Wax Spray Required |

7. Conclusion

For export of dozers and excavators from China, RO-RO offers the optimal balance of cost, speed, and safety for self-propelled units. Flat Rack is superior for large or non-operational excavators requiring structural integrity. Bulk Cargo remains a cost-effective option for high-volume, lower-value shipments but demands rigorous anti-corrosion protocols.

Critical Success Factor: Universal application of industrial-grade wax spraying is non-negotiable for all methods to ensure equipment arrives in operational condition, minimizing post-delivery maintenance and warranty claims.

Prepared by: SEA LION International – Heavy Equipment Logistics Division

Date: March 2026

Document ID: SL-LOG-2026-041

Revision: 1.2

Get a Quote for Dozer Vs Excavator

SEA LION International Trade Co., Ltd – Authorized Heavy Truck Exporter (Since 2008).

👤 Contact Person: Mr. Danny Xi

📱 Mobile/WhatsApp/WeChat: +86 130 1170 7382

📧 Email: [email protected]